In a recent webinar “Rethinking Bonding Curves,” hosted by the Crypto Oracle, participants delved into the complex world of bonding curves. This session featured insights from four experts: (Director, Swarm Foundation), Christof Cloete (Market Maker, CLS Global), Elad Verbin (Lead Scientist, Lunar Ventures), and Benji Leibowitz (Director of Product, Molecule AG), moderated by Lou Kerner.

The discussion aimed to unpack the intricacies of bonding curves in the crypto space, particularly in relation to the Swarm Network community vote that was announced in a previous blog post. This comprehensive summary encapsulates the diverse perspectives and insights shared by the panellists, each bringing their unique experiences in the space.

The essence of Swarm and its bonding curve

The webinar was opened by who introduced the Swarm Network and its mission to empower digital freedom. He detailed the inception of the bonding curve in 2021, aimed at facilitating token access without intermediaries and ensuring price stability. Gregor emphasised the project’s evolution and the emerging need to reassess the bonding curve, stressing the vital role of the community in deciding the path forward.

This is because, he underlined, critical reflections on the theoretical versus practical effects of bonding curves were raised. He emphasised the importance of involving the community in these discussions, considering their crucial role in decentralised projects. He advocated for an exploratory approach to understand the real-world implications of bonding curves on the project’s economics and token dynamics.

Gregor highlighted the key trade-offs introduced by the bonding curve:

Control vs. Flexibility: The fixed nature of the bonding curve provides a form of monetary policy control, ensuring predictability in the token’s liquidity and price. However, this control comes at the cost of flexibility, limiting the project’s capacity to swiftly adjust its monetary policy in response to market changes.

Price Stability vs. Market Forces: One of the initial motivations for deploying bonding curves was to provide price stability. However, this aim can sometimes clash with natural price discovery processes driven by market forces. Gregor highlighted the tension between preserving a stable token price through the bonding curve and allowing market dynamics to play out freely.

Transparency vs. Complexity: While bonding curves offer transparency in how prices are determined, their mathematical and conceptual complexity may hinder broader participation. This trade-off emphasises the need for finding a balance between maintaining open and transparent mechanisms and ensuring they are accessible and understandable to a wider audience.

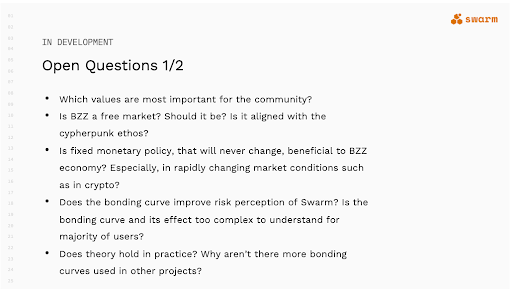

Additionally, he also elaborated the open questions for collective exploration:

Theory vs. Practice: Gregor raised the open question of whether the theoretical benefits of bonding curves match their actual performance. Despite the initial deployment of Swarm’s bonding curve with specific objectives in mind, the real-world achievement of these goals e necessitates further investigation and data-driven analysis.

Fixed Monetary Policy: The discussion delved into whether a fixed monetary policy, as imposed by the bonding curve, is beneficial or detrimental to the project’s economy, especially in a market as volatile as crypto. Gregor questioned the adaptability of such a policy in responding to rapidly changing market conditions.

Risk Perception and Complexity: Another significant question was whether the bonding curve improves or worsens the risk perception of Swarm’s token. The complexity of bonding curves could deter general understanding and participation, potentially affecting individuals’ willingness to engage with the token.

Success of Projects Using Bonding Curves: Gregor sought insights into why there aren’t more projects successfully utilising bonding curves and what can be learned from those who do. This question points towards a need for case studies and analyses to understand the conditions under which bonding curves thrive.

In summary, Gregor highlighted the elements that voters should consider when analysing the benefits and drawbacks of the bonding curve in the upcoming vote.

Bonding curves: a tool for intellectual property

In the “Rethinking Bonding Curves” webinar, Benji Leibowitz provided insightful commentary on using bonding curves for funding intellectual property (IP), specifically within drug development, from the perspective of Molecule. In particular, he shared insights from the journey of moving bonding curves from a theoretical concept to practical use, highlighting key lessons learned along the way.

“How do we leverage bonding curves to trade ownership in intellectual property?”

Molecule’s initial enthusiasm

Despite the initial enthusiasm for leveraging bonding curves to model the value inflection points across the drug development process, practical challenges soon revealed the limitations of bonding curves in predicting pharmaceutical market trends accurately.

This led to a pivot in Molecule’s approach, viewing bonding curves not as a one-size-fits-all solution but as a mechanism best suited for initial liquidity bootstrapping. Benji discussed plans for relaunching Catalyst, a project employing bonding curves for early-stage funding phases, before transitioning to other market structures to ensure sustainable long-term trading.

Indeed, bonding curves were an innovative funding model that caught the attention of Molecule’s team with their promise of a dynamic method for pricing and trading ownership in IP assets, potentially revolutionising the way early-stage biotech projects are funded.

The appeal of bonding curves was partly due to their theoretical underpinnings, which suggested that they could accurately model the value inflection points inherent in the drug development process. This was seen as a way to create a mathematical function that could represent the price of an IP asset based on its development stage. However, despite the initial enthusiasm, they encountered significant challenges when applying bonding curves in practice; they found that the assumptions underlying the curves did not always hold true in the complex and unpredictable world of biotech funding. For example, one major lesson was that the market dynamics of IP assets, especially drugs, could shift dramatically as new information emerged during development. A drug initially developed for one condition might find applications in another, fundamentally altering its market potential and, by extension, its value.

Pivot - Bonding curve as a tool for initial liquidity

These challenges led to a pivot in Molecule’s approach to bonding curves. Instead of viewing them as a one-size-fits-all solution, the team began to see bonding curves more as a tool for initial liquidity and community engagement, rather than as a long-term market structure for trading IP assets. Under these lenses, Benji discussed plans to relaunch Catalyst, a project within Molecule that uses bonding curves to fund research projects. The relaunch aims to utilise bonding curves for their strength in bootstrapping liquidity, allowing researchers to quickly gather funding from the community.

“Where we see the primary utility in bonding curves is for early stage fundraising, less so for creating a sustainable market”

In summary, through practical experimentation and adaptation, Molecule has navigated the complexities of applying theoretical financial models to the real-world challenges of funding drug development. After the initial funding phase, Molecule plans to transition the projects away from bonding curves to more traditional market structures, and this reflects an evolved understanding of bonding curves as valuable for initial phases but potentially limiting for long-term growth and trading.

A market maker’s view on bonding curves

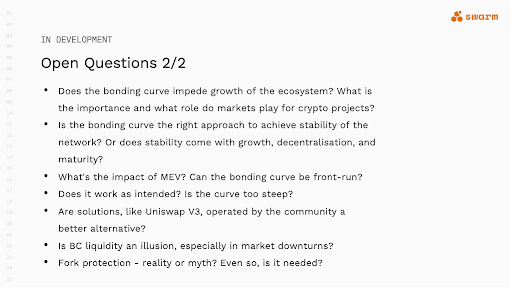

Christof Cloete focused on the implications of the bonding curve as a financial instrument from a market maker’s viewpoint, illuminating the operational challenges and strategic limitations that bonding curves can impose, particularly in the dynamic and often volatile nature of cryptocurrency markets. He highlighted how the intrinsic design of bonding curves impose certain operational constraints on market makers. These constraints stem from the predefined mathematical relationship between the price and supply of tokens, which limits the flexibility market makers have in deploying various trading strategies to respond to market conditions.

“The reliance on a predetermined formula to dictate trading conditions means market makers cannot easily adjust their strategies (…). This rigidity can be particularly challenging in the fast-paced and unpredictable crypto market, where adaptability is key to maintaining liquidity and stabilizing token prices"

Predictability - a strength or a weakness

Indeed, the reliance on a predetermined formula to dictate trading conditions underlines a critical dilemma; while it offers stability and reliability, it simultaneously restricts market makers’ ability to swiftly adapt to sudden market movements or changing investor sentiment. This rigidity can be particularly challenging in the fast-paced and unpredictable crypto market, where adaptability is key to maintaining liquidity and stabilising token prices. Christof weighed the balance between the early-stage stability that bonding curves can provide to a project against the need for greater market responsiveness as a project and its token evolve. While bonding curves can offer a predictable mechanism for token pricing and liquidity, this very characteristic can become a limitation as the project seeks to adapt to broader market dynamics.

This is because the predictability of bonding curves can be seen as both an asset and a liability. On one hand, predictability can contribute to a more stable and trustworthy project environment. On the other hand, it can stifle the creativity and tactical adjustments market makers might otherwise employ to optimise trading strategies and improve market liquidity.

Christof advocated for a nuanced approach to their application. In the initial stages of a project, bonding curves can play a crucial role in establishing a base level of liquidity and enabling the project to gain traction. However, as the project evolves, it may become necessary to adapt or even move away from the bonding curve model. This shift would allow for more dynamic market-making strategies that can better support the project’s continued growth and contribute to the stability of its token in the market.

Analysing bonding curves from a technical perspective

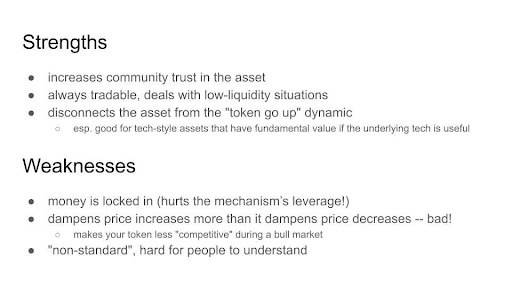

Elad Verbin offered a deep dive into the theoretical underpinnings and practical implications of using bonding curves both from a computer science and venture capital perspective. He meticulously analysed the strengths and weaknesses of bonding curves, providing insights into their applicability and potential evolution in decentralised finance (DeFi) projects.

The fascination of bonding curves

Elad started by positioning bonding curves as an innovative alternative to traditional double-sided order books used in financial markets. He appreciated their theoretical capacity for precise price discovery, emphasising that under ideal conditions, bonding curves could accurately reflect the value of an asset as perceived by the market participants.

Market fluctuations - how to best capture them

One of the key benefits Elad highlighted was the potential of bonding curves to smooth out price volatility, making them particularly appealing for assets with low liquidity. By requiring significant financial input to move the price substantially, bonding curves can offer a more stable pricing mechanism compared to the rapid fluctuations often seen in order book-based markets. In other words, bonding curves could enhance community trust and engagement by providing a transparent and algorithm-driven approach to pricing and liquidity, crucial in a project’s early stages to build a loyal user base and secure active participation.

However, this comes at a price: a significant drawback of bonding curves, as stressed by Elad, is the inefficient lock-in of capital; this is because the mechanism requires a substantial amount of funds to be injected into the curve to facilitate price adjustments, which could otherwise be utilised more productively within the ecosystem or for further development of the project.

Another critical issue is the dampening effect on upward price movements. While stabilising downward price volatility might seem beneficial, the same mechanism could hinder the token’s ability to capture market optimism and growth, potentially making it less attractive to investors seeking active market engagement. In other words, bonding curves restrict growth more than soft drops.

The human component

Moreover, he also emphasised the human component involved in the complexity of understanding and interacting with bonding curves, which could pose a barrier to broader adoption. For participants accustomed to traditional market mechanisms, the leap to bonding curve-based systems can be daunting, potentially limiting the project’s appeal to a wider audience.

Conclusion

The webinar organised by Crypto Oracle offered a rich tapestry of insights into the nuanced world of bonding curves, blending theoretical insight with practical experience. A recurring theme was the paramount importance of community involvement in shaping the development of these financial mechanisms within decentralised projects. This conversation not only illuminated the inherent complexities and compromises of using bonding curves, but also charted a path forward that emphasises clarity, community engagement, and continuous innovation. As we navigate the future of bonding curves, it’s clear that a collaborative approach, informed by the shared experiences and wisdom of the community, will be key to harnessing their full potential in the evolving landscape of decentralised finance.

Discussions about Swarm can be found on Reddit.

All tech support and other channels have moved to Discord!

Please feel free to reach out via info@ethswarm.org

Join the newsletter! .